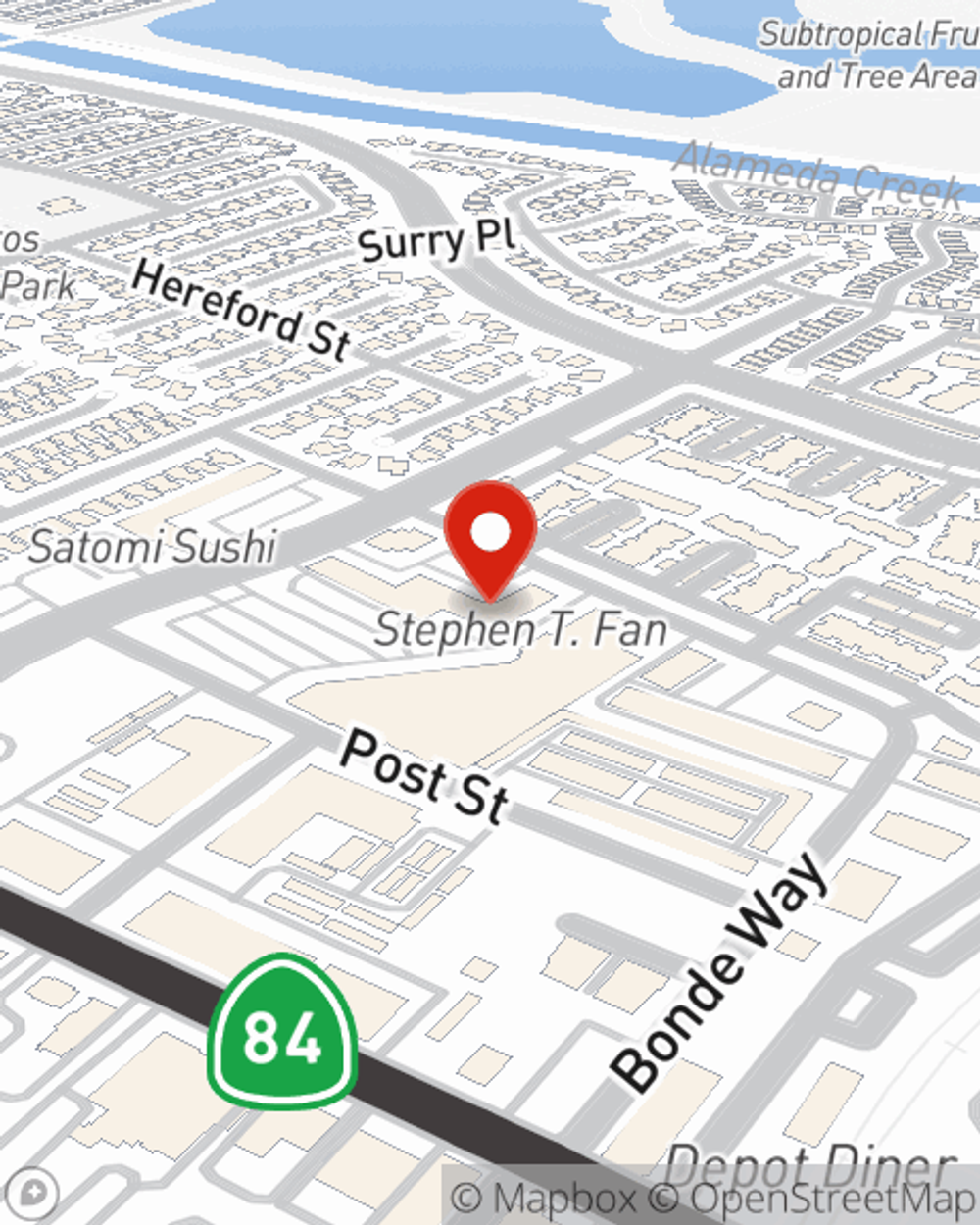

Business Insurance in and around Fremont

Looking for small business insurance coverage?

Helping insure small businesses since 1935

State Farm Understands Small Businesses.

Running a small business is hard work. Finding the right coverage should be the least of your worries. State Farm insures small businesses that fall under the umbrella of retailers, contractors, specialized professions and more!

Looking for small business insurance coverage?

Helping insure small businesses since 1935

Get Down To Business With State Farm

The passion you have to be a leader in your field is a great foundation. When you add business insurance from State Farm, you can be ready for the challenges ahead. That’s why entrepreneurs and business owners turn to State Farm Agent Ninna Chugh. With an agent like Ninna Chugh, your coverage can include great options, such as commercial liability umbrella policies, business owners policies and artisan and service contractors.

As a small business owner as well, agent Ninna Chugh understands that there is a lot on your plate. Get in touch with Ninna Chugh today to discover your options.

Simple Insights®

Commonly asked Business Continuation questions

Commonly asked Business Continuation questions

Check out the answers to these commonly asked business continuation questions.

Small business types

Small business types

What is a sole proprietorship, an LLC and other small business types — and which one is best for you?

Ninna Chugh

State Farm® Insurance AgentSimple Insights®

Commonly asked Business Continuation questions

Commonly asked Business Continuation questions

Check out the answers to these commonly asked business continuation questions.

Small business types

Small business types

What is a sole proprietorship, an LLC and other small business types — and which one is best for you?